Jungfrau Railway Group

Notes to the consolidated financial statements

With an annual profit of CHF 53.3 million, the Jungfrau Railway Group increased its earnings in 2019 by 11.5% compared to the previous year.

The Jungfrau Railway Group generated a total operating income of CHF 223.3 million, which corresponds to an increase of CHF 10.5 million. The most important source of income remains transport revenue, which amounted to CHF 161.8 million in the reporting year – 5.2% or CHF 8.0 million above the previous year’s amount. Operating expenses rose by 2.3% to CHF 120.4 million. EBITDA rose accordingly by 8.3% and, at CHF 103.0 million, exceeded the CHF 100 million mark for the first time. Depreciation and amortisation amounted to CHF 35.5 million. EBIT increased by 10.7% to CHF 67.5 million, which corresponds to an EBIT margin of 30.2%. After a positive financial result and after taxes, the annual accounts show an annual profit of CHF 53.3 million, CHF 5.5 million above the previous year. Cash flow (from operating activities) rose by 21.5% to CHF 97.1 million.

2019 was all about building the core elements of the V-Cableway project. In mid-December, important milestones were reached with the opening of the Grindelwald Terminal station of the Bernese Oberland Railway, the new Männlichen Railway and the partial opening of the terminal. All other construction sites were also busy throughout the year. The Jungfrau Railway Group’s total investment volume last year was CHF 118.6 million. Of this, CHF 83.6 million was accounted for by the V-Cableway project. In recent years, the company has invested just under CHF 250 million into the once-in-a-generation project, which includes the already completed rolling stock renewals at the Wengernalp Railway and Jungfrau Railway in addition to the core elements of the Eiger Express, Grindelwald Terminal and multi-storey car park.

In addition to the V-Cableway, a second major project was launched – the renewal programme for the Lauterbrunnen-Mürren mountain railway. Costs of a good CHF 50 million have been estimated for the complete renewal of the Mürrenbahn, largely financed by the Canton of Bern. CHF 2.7 million was invested in the reporting year. The acquisition of the former bank building on Höheweg in Interlaken and its subsequent conversion into Jungfrau Railways’ first flagship store, including facilities, cost CHF 16.1 million. The station concourse on the Jungfraujoch will be under renovation until spring 2021. CHF 5.1 million was invested in the reporting year. In addition, orders were placed for the rolling stock of the Wengen Shuttle and advance payments of CHF 4.0 million were made.

With the exception of CHF 1.3 million in interest-free infrastructure loans from the public sector for the Lauterbrunnen-Wengen and Lauterbrunnen-Mürren routes and a first instalment of CHF 7.8 million of an investment aid loan for Grindelwald Grund Infrastruktur AG to partially finance the terminal, the investments were financed entirely from cash flow.

The consolidated balance sheet as of 31 December 2019 shows equity of CHF 607.3 million. This results in a very solid equity ratio of 79.0%. The company continues to operate without interest-bearing debts and has liquid assets of CHF 57.4 million. The Jungfrau Railway Group is therefore well prepared for the intensive investment phase lasting until the completion of the V-Cableway project with the planned operative launch of the Eiger Express in December 2020.

Information on the business segments

The most important segment, Jungfraujoch – Top of Europe, achieved net sales of CHF 149.8 million. The increase of 7.6% is based on the long-standing, intensive and successful development of the Asian markets. With 1,056,000 visitors, more than a million guests travelled to Jungfraujoch – Top of Europe in the reporting year, for the fourth time following 2015, 2017 and 2018. Transport revenue increased by 1.8% to CHF 120.9 million. Encouragingly, average revenues also rose again, by 2.7% to CHF 114.50 per guest. The Top of Europe Flagship Store was opened in Interlaken on 12 October and on 1 November, operation of the Jungfraujoch and Eigergletscher restaurant businesses was assumed. Overall, the business segment posted earnings before interest, taxes, depreciation and amortisation (EBITDA) of CHF 70.5 million.

For the fourth time in a row, higher earnings were achieved in winter sports. The number of ski visits (of ski sport guests) in the entire Jungfrau Ski Region rose by 8.4% compared to the previous year to 1,069,500, exceeding the one million mark for the first time since 2013. The Group’s proportionate transport revenue increased by 5.1% to CHF 23.5 million. With net sales of CHF 30.8 million, the segment achieved an EBITDA of CHF 1.7 million.

The sharpest rise was in Experience Mountains. All participating railways – the Harder Railway, First Railway and the Lauterbrunnen-Mürren Mountain Railway – once again achieved new records in transport revenue. This resulted in an overall net increase of 21.1% to CHF 25.0 million. The independent positioning of all Experience Mountains and consistent cross-selling proved worthwhile. Overall, segment sales for the Experience Mountains rose by 18.9% to CHF 32.6 million, accompanied by a 30.3% increase in EBITDA to CHF 18.8 million.

Strategic financial targets

The strategic financial targets of the Jungfrau Railway Group reflect the orientation towards long-term goals and the policy of a value-based company (value stock). The current financial targets were reviewed for the last time in 2014.

| Key figure | Target value |

|---|---|

| Return on sales | ≥ 12% |

| EBIT margin | ≥ 15% |

| Investments / cash flow | < 50% |

| Payout ratio | 33% – 50% |

| Cumulative free cash flow 2014‒2023 | ≥ CHF 150 Mio. |

| Equity ratio | > 70% |

In 2019, the Jungfrau Railway Group exceeded its targets with the exception of the investment/cash flow indicator. The return on sales amounted to 23.9%, the EBIT margin reached 30.2%. With the proposed dividend of CHF 2.80 per share (previous year CHF 2.80), the payout ratio at 30.8% is slightly below the defined target range. Investments in the reporting year accounted for 122.2% of cash flow. For 2019, this resulted in a free cash flow of CHF -21.5 million. The accumulated free cash flow for the 2014–2023 target period at the end of 2019 therefore amounts to CHF 52.0 million. At the same time, the equity ratio was 79.0%.

In the course of the V-Cableway realisation, the financial targets were reviewed and aligned with the time after entering into full operation. The system of objectives should remain clear and simple.

The Jungfrau Railway Group will continue to strive for development and financing based on solid results in the future. After the investment-intensive phase with the V-Cableway project, the scope for dividend payments will be increased. Investments should continue to be financed from self-generated funds wherever possible. In the future, interest-bearing debt capital will continue to be raised only in a limited scope and only for operational investments. The Jungfrau Railway Group thus underlines its claim to be solidly financed and to be able to act independently of outside capital providers at all times.

The Board of Directors has therefore formulated the following financial targets for the years after the V-Cableway enters into operation:

| Key figure | Target value |

|---|---|

| Return on sales | ≥ 18% |

| EBITDA margin | ≥ 40% |

| Payout ratio | 35% – 60% |

| Cumulative free cash flow 2014‒2023 | ≥ CHF 150 Mio. |

| Interest-bearing borrowed capital | ≤ 10% |

The EBITDA margin target is new and replaces the EBIT margin indicator. EBITDA is a common benchmark in the mountain railway industry and indicates how much cash flow can be generated from the operating business. Instead of the equity ratio, a limit for interest-bearing debt capital is introduced. An EBITDA margin of 46.1% was achieved in 2019. As of 31 December 2019, the consolidated balance sheet does not show any interest-bearing liabilities. Due to the widely varying level of investment, the annual investment/cash flow target of <50% will be waived in future. The targeted limitation of investments is ensured by the free cash flow target and the limitation of interest-bearing debt.

Risk management and ICS

Within the framework of risk management, Jungfrau Railways deals with possible events whose occurrence could mean that its strategic and thus the financial goals cannot be achieved. We assess such events in terms of their probability of occurrence and their likely impact on EBIT. Events may include commercial success, partnerships, reputation, organisation (especially personal safety, material assets, availability, integrity, confidentiality of data and the assurance of expertise), finances, governance, and compliance. Risk management identifies both opportunities and threats. Strategic risks are regularly discussed as part of the Board of Directors’ SWOT analysis. In the management report, we focus heavily on the commercial challenges (see message from the company management/opportunities and risks).

Jungfrau Railways has an internal control system (ICS) that meets legal requirements. With this instrument, we firstly check compliance with processes and the integrity of data in the particularly sensitive area of finance and secondly ensure security with regard to the accuracy and reliability of reporting.

The IT security policy of Jungfrau Railways pursues a best-practice approach. The rules are defined in the IT security policy, the IT security guidelines for employees, and the IT password guidelines or user authorisation plan. In addition, special service levels are defined for all business-relevant applications in line with the respective risks and a specialist group monitors the change process. The in-house data protection officer oversees the 60 or so data files that include sensitive personal data, advises the data controllers regarding handling of these data and reports to the Executive Board at least once a year on data protection concerns and the results and conclusions from said officer’s investigations. Jungfrau Railways is guided by the General Data Protection Regulation (GDPR) of the EU, although the Swiss law formally implementing it is not yet in force.

Risk management is embedded in the company’s general process landscape. Process organisation specifies responsibilities and ensures that the relevant measures are planned and implemented. The corresponding risk index (risk catalogue) forms the central basis for the formal risk process. The risks are assessed according to financial impact and probability of occurrence and positioned based on their importance for the company (risk profile). The risk catalogue of Jungfrau Railways provides an overview of the operational risks and is revised annually. The Board of Directors discusses and supplements the strategic risks at least once a year and in addition as required. The strategic catalogue has always included a pandemic, a risk that is currently a major concern. What this means in concrete terms is described by the company management in its current message in the management report. The external and internal audit activities are closely linked to risk management. In addition to internal audits, which are used by the Executive Board to check certain areas for risks, Jungfrau Railways is regularly externally audited by the Swiss Federal Office of Transport, Suva, and the certification body for quality management according to ISO 9001/2015.

The increasing density of regulation, which goes hand in hand with public awareness of compliance issues, has recently been explicitly included in the Board of Directors’ SWOT analysis. This results in efforts to continuously expand compliance. While the safety of our employees and our clients remains our top priority, the company is constantly faced with additional legal and regulatory requirements in a wide variety of areas. As a small listed company, it is a challenge for Jungfrau Railways to meet all the rules correctly, even to set standards in some areas, while at the same time ensuring costs do not explode and innovation is not hindered. A compliance management system was set up in 2019 with this objective in mind. In February 2020, the new Jungfrau Railways Code of Conduct was adopted by the Board of Directors. The most important innovation is the prohibition of accepting and giving gifts worth more than CHF 300. The implementation of structural measures, in particular the assignment of the Compliance Officer’s duties to an independent unit, will take place in the course of this year in view of the comprehensive reorganisation of the entire management as of 1 January 2021.

The failure of projects is a significant risk position in the catalogue of a naturally investment-driven transport company that must maintain and constantly renew cable cars and railways. The major V-Cableway project currently poses corresponding challenges for our project management. This is carried out by a board formed specifically from representatives of Jungfrau Railways and Gondelbahn Grindelwald-Männlichen AG. Every three months, this body reports to the Board of Directors of Jungfraubahn Holding AG, Berner Oberland-Bahnen AG, and Gondelbahn Grindelwald-Männlichen AG. In addition to the cost control, the schedule and the monitoring of the necessity and added value of any project adjustments, the safety, allocation of tasks, preparation of the handover and the quality and specific risks of the construction are discussed. The internal reporting is supplemented by a report from an independent expert.

Consolidated balance sheet

| CHF (thousands) | Note | 2019 | % | 2018 | % |

|---|---|---|---|---|---|

| Assets | |||||

| Current assets | |||||

| Liquid funds | 57,432 | 87,390 | |||

| Receivables from deliveries and services | 1 | 13,953 | 14,637 | ||

| Other current receivables | 2 | 12,331 | 21,673 | ||

| Inventories souvenir shops and catering | 2,704 | 1,784 | |||

| Accrued income | 3 | 9,349 | 6,615 | ||

| Total current assets | 95,769 | 12.5% | 132,099 | 18.5% | |

| Fixed assets | |||||

| Financial assets | 4 | 7,130 | 6,297 | ||

| Tangible assets | 5 | 655,663 | 567,097 | ||

| Intangible assets | 6 | 10,275 | 8,823 | ||

| Total fixed assets | 673,068 | 87.5% | 582,217 | 81.5% | |

| Total Assets | 768,837 | 100.0% | 714,316 | 100.0% | |

| Liabilities | |||||

| Outside capital | |||||

| Liabilities from deliveries and services | 7 | 38,238 | 28,169 | ||

| Current financial liabilities | 8 | 740 | 740 | ||

| Other current liabilities | 9 | 4,805 | 7,589 | ||

| Current provisions | 10 | 2,266 | 2,050 | ||

| Deferred income | 11 | 23,981 | 23,606 | ||

| Total current borrowed capital | 70,030 | 9.1% | 62,154 | 8.7% | |

| Non-current financial liabilities | 8 | 50,339 | 41,271 | ||

| Other non-current liabilities | 436 | 0 | |||

| Non-current provisions | 10 | 40,723 | 41,231 | ||

| Total non-current borrowed capital | 91,498 | 11.9% | 82,502 | 11.6% | |

| Total borrowed capital | 161,528 | 21.0% | 144,656 | 20.3% | |

| Equity | |||||

| Share capital | 24 | 8,753 | 8,753 | ||

| Capital reserves | -980 | -1,425 | |||

| Treasury shares | 24 | -144 | -440 | ||

| Retained earnings | 595,209 | 558,506 | |||

| Equity shareholders of Jungfraubahn Holding AG | 602,838 | 565,394 | |||

| Minority interests | 4,471 | 4,266 | |||

| Total equity | 607,309 | 79.0% | 569,660 | 79.8% | |

| Total liabilities | 768,837 | 100.0% | 714,316 | 100.0% |

Consolidated income statement

| CHF (thousands) | Note | 2019 | 2018 |

|---|---|---|---|

| Operating income | |||

| Transportation revenues | 12 | 161,807 | 153,833 |

| Compensation | 13 | 10,551 | 10,254 |

| Sale of energy | 10,043 | 11,017 | |

| Souvenir shops | 8,751 | 8,763 | |

| Catering and accommodation | 5,723 | 4,382 | |

| Service income | 8,722 | 7,455 | |

| Rental income | 14 | 8,550 | 8,168 |

| Other income | 15 | 9,163 | 8,943 |

| Total operating income | 223,310 | 212,815 | |

| Operating expenses | |||

| Cost of goods | 16 | -5,583 | -5,453 |

| Purchase of energy | -2,305 | -2,112 | |

| Personnel expenses | 17 - 19 | -62,090 | -60,173 |

| Other operating expenses | 20 | -50,374 | -49,966 |

| Total operating expenses | -120,352 | -117,704 | |

| EBITDA | 102,958 | 95,111 | |

| Depreciation and amortisation | |||

| Depreciation of tangible assets | 5 | -33,166 | -32,325 |

| Amortisation of intangible assets | 6 | -2,288 | -1,817 |

| Total depreciation and amortisation | -35,454 | -34,142 | |

| EBIT | 67,504 | 60,969 | |

| Financial result | |||

| Financial expenses | 21 | -254 | -364 |

| Results from associated companies | -7 | -3 | |

| Financial income | 22 | 452 | 360 |

| Total financial result | 191 | -7 | |

| Profit before tax | 67,695 | 60,962 | |

| Income taxes | 23 | -14,351 | -13,136 |

| Annual profit | 53,344 | 47,826 | |

| Shareholders of Jungfraubahn Holding AG | 52,976 | 47,914 | |

| Minority interests | 368 | -88 | |

| Result per share | |||

| Shares issued | 5,835,000 | 5,835,000 | |

| Average balance of time-weighted treasury shares | -20,138 | -8,154 | |

| Average number of time-weighted outstanding shares | 5,814,862 | 5,826,846 | |

| Undiluted and diluted result per share | CHF | 9.11 | 8.22 |

Consolidated cash flow statement

| CHF (thousands) | Note | 2019 | 2018 |

|---|---|---|---|

| Annual profit | 53,344 | 47,826 | |

| Depreciation of tangible assets | 5 | 33,166 | 32,325 |

| Amortisation of intangible assets | 6 | 2,288 | 1,817 |

| Change of provisions | 10 | -292 | -688 |

| Book profits from the sale of fixed assets | -70 | -253 | |

| Book profits from the sale of financial assets | -2 | -12 | |

| Results from associated companies | 7 | 3 | |

| Badwill from the acquisition of subsidiary shares | 22 | -112 | -6 |

| Other non-cash items [1] | 2,368 | 1,968 | |

| Cash flow before change in net current assets | 90,697 | 82,980 | |

| Decrease / increase in receivables from deliveries and services | 684 | -5,058 | |

| Decrease / increase in other current receivables | 2 | 9,342 | -5,877 |

| Increase / decrease in inventories | -920 | 169 | |

| Increase / decrease in accrued income | -2,734 | 160 | |

| Increase / decrease in liabilities from deliveries and services [2] | 2,426 | -2,001 | |

| Decrease / increase in other short-term liabilities | -2,784 | 2,637 | |

| Use of provisions | 10 | 0 | -100 |

| Increase in deferred income | 375 | 6,975 | |

| Cash flow from operating activities | 97,086 | 79,885 | |

| Investments in tangible assets [2] | 5 | -114,826 | -62,990 |

| Investments in financial assets | 4 | -840 | 0 |

| Investments in intangible assets [3] | 6 | -3,740 | -1,903 |

| Divestment of tangible assets | 5 | 807 | 892 |

| Divestment of financial assets | 4 | 2 | 421 |

| Cash flow from investing activities | -118,597 | -63,580 | |

| Free cash flow | -21,511 | 16,305 | |

| Increase in financial liabilities | 8 | 10,971 | 5,580 |

| Repayment of financial liabilities | 8 | -1,903 | -740 |

| Deposit right of use Terminal Grund | 8 | 440 | 0 |

| Purchase of minority shares | -2 | -2 | |

| Investment in own shares incl. transaction costs | -2,645 | -2,925 | |

| Divestment of own shares | 1,007 | 906 | |

| Transaction costs for divestment of own shares | -3 | -2 | |

| Profit distribution to minority interests | -39 | -20 | |

| Profit distribution Jungfraubahn Holding AG | -16,273 | -13,996 | |

| Cash flow from financing activities | -8,447 | -11,199 | |

| Change in liquid assets | -29,958 | 5,106 | |

| Liquid funds 1 January | 87,390 | 82,284 | |

| Liquid funds 31 December | 57,432 | 87,390 | |

| Change in liquid assets | -29,958 | 5,106 |

Consolidated statement of shareholders' equity

| CHF (thousands) | Note | Share capital | Capital reserves | Treasury shares | Retained earnings | Equity shareholders of Jungfraubahn Holding AG | Minority interests | Total equity |

|---|---|---|---|---|---|---|---|---|

| Equity at 01/01/2018 | 8,753 | -1,417 | -399 | 524,588 | 531,525 | 4,386 | 535,911 | |

| Acquisition of own shares | 24 | -8 | -2,917 | -2,925 | -2,925 | |||

| Sale of treasury shares | 24 | 0 | 2,876 | 2,876 | 2,876 | |||

| Annual profit | 47,914 | 47,914 | -88 | 47,826 | ||||

| Dividends | -13,996 | -13,996 | -20 | -14,016 | ||||

| Purchase of subsidiary shares | 0 | -12 | -12 | |||||

| Equity at 31/12/2018 | 8,753 | -1,425 | -440 | 558,506 | 565,394 | 4,266 | 569,660 | |

| Acquisition of own shares | 24 | -7 | -2,638 | -2,645 | -2,645 | |||

| Sale of treasury shares | 24 | 452 | 2,934 | 3,386 | 3,386 | |||

| Annual profit | 52,976 | 52,976 | 368 | 53,344 | ||||

| Dividends | -16,273 | -16,273 | -39 | -16,312 | ||||

| Purchase of subsidiary shares | 0 | -124 | -124 | |||||

| Equity at 31/12/2019 | 8,753 | -980 | -144 | 595,209 | 602,838 | 4,471 | 607,309 |

Annexes to the consolidated financial statements

Accounting principles

General information

The consolidated financial statements are prepared on the basis of commercial operating values and in accordance with accounting recommendations (Swiss GAAP FER) and the Swiss Stock Corporation Act. They provide a true and fair view of the Group's net assets, financial position and results of operations. Consolidation is based on audited and unified financial statements prepared by the Group companies.

The financial statements of Jungfraubahn Holding AG and the consolidated financial statements of the Jungfraubahn Group were approved by the Board of Directors on 25 March 2020.

Closing date

The uniform closing date for all companies included in the consolidation is 31 December. The associated company Skilift Bumps AG is an exception to this rule (30 June). As in previous years, Skilift Bumps AG due to the lesser importance of the company does not have to prepare interim financial statements as at 31 December.

Scope of consolidation

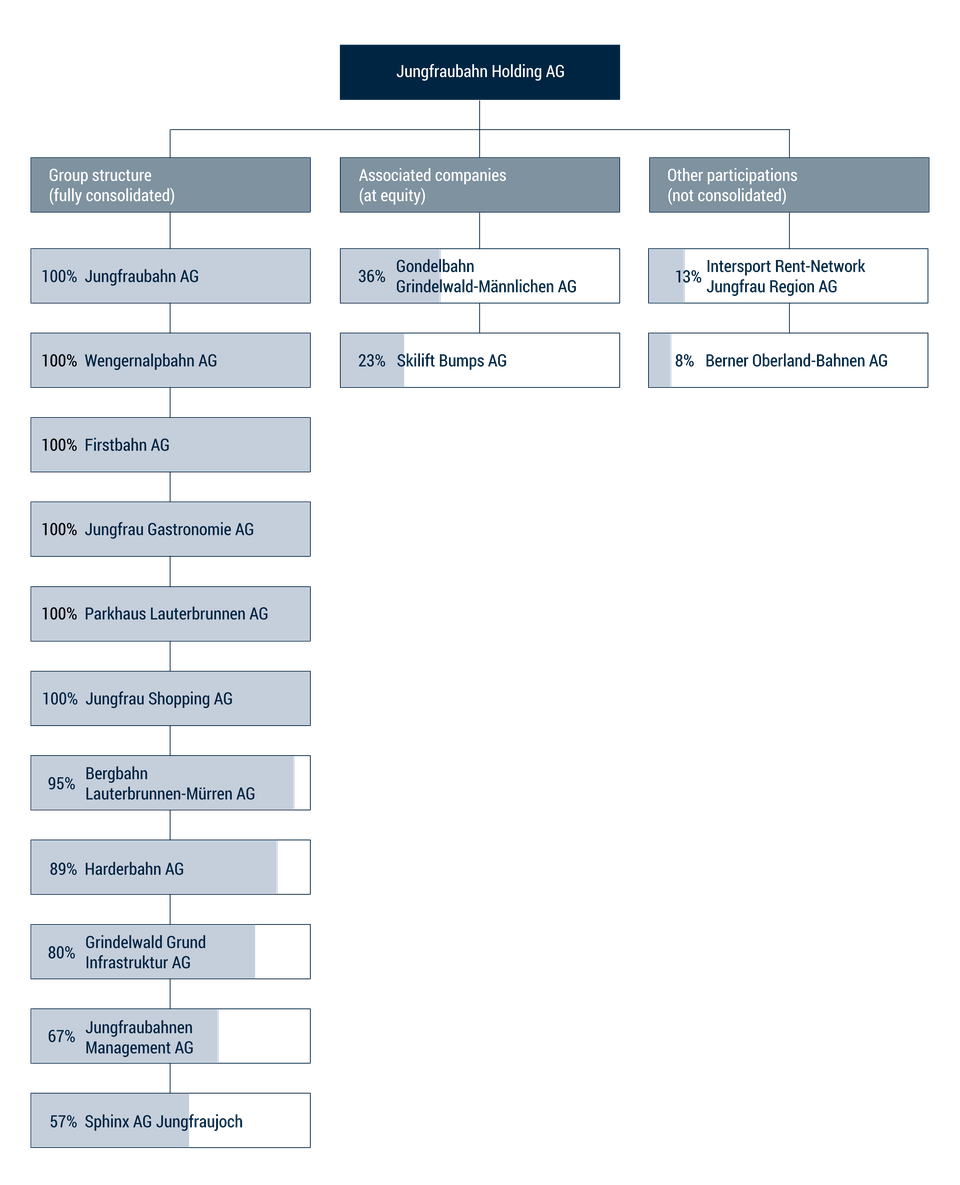

The consolidated financial statements include the financial statements of Jungfraubahn Holding AG and its holdings. The holdings of the Group can be seen in the comment «0 Scope of consolidation» below. The holdings are broken down as follows:

Group companies

Group companies are companies in which Jungfraubahn Holding AG has a direct or indirect share of more than 50 per cent.

Associated companies

Associated companies are companies in which Jungfraubahn Holding AG holds 20 to 50 per cent.

Non-consolidated holdings

Non-consolidated holdings (up to 20 per cent) are reported under «financial assets».

Consolidation method

Group companies

Assets and liabilities, as well as expenses and income, are 100 per cent accounted for according to the full consolidation method. Capital consolidation is carried out according to the Anglo-Saxon method (purchase method). Goodwill paid in connection with a share acquisition is usually depreciated over 5 years, in justified cases over 20 years. A passive difference (badwill) is credited to the income statement in the financial year.

The minority interests in equity and income are shown separately on the balance sheet and the income statement. Receivables, liabilities as well as deliveries and services between group companies, including resulting profits, are eliminated.

Associated companies

These companies are included in the consolidated financial statements using the equity method less value adjustments necessary for economic reasons.

Non-consolidated holdings

The non-consolidated participations reported in the «financial investments» are valued at the acquisition cost less value adjustments necessary for economic reasons.

Valuation principles

Balance sheet items are valued according to uniform guidelines. The valuation is based on the acquisition or production costs (principle of historical costs). The most important rules for the various items are set out below:

Foreign currencies

The conversion of positions in foreign currencies is carried out according to the closing rate method. The effects from foreign currency adjustments are recorded in the period result.

Receivables

Receivables are stated at the nominal value less value adjustments necessary for economic reasons.

Inventories

In particular, articles sold in souvenir shops and inventories of restaurants are included in this item. The valuation is carried out at acquisition cost or - if this is lower - at the realisable disposal value. Any discounts are recorded as a reduction in acquisition costs. Consumables and operating materials are reported as «deferred accruals» in the sense of prepaid expenses.

Tangible assets

Property, plant and equipment and spare parts are recognised at acquisition or production values and amortised using the straight-line method over the estimated period of their use (spare parts corresponding to the period of the related property, plant and equipment). Land is not amortised. The planned useful lives for:

| Investment item | Years |

|---|---|

| Railway stations | 50 |

| Depots and workshops | 50 |

| Railway substructure and superstructure | 25 – 80 |

| Gondola lift, chairlift and ski lift stations | 20 – 50 |

| Ski slopes and fixed snowmaking equipment | 10 – 25 |

| Hiking trails and climbing routes | 20 – 30 |

| Power plant and technical water buildings | 50 – 80 |

| Restaurants and accommodation | 10 – 50 |

| Car parks and parking spaces | 20 – 40 |

| Residential buildings | 50 |

| Administration buildings | 50 |

| Other buildings | 50 |

| Railway installations | 15 – 40 |

| Gondola lifts | 30 |

| Chairlifts and ski lifts | 10 – 30 |

| Snowmakers | 6 – 10 |

| Power plant and technical water facilities | 10 – 40 |

| Other facilities | 10 – 40 |

| Rail vehicles | 30 |

| Slope vehicles | 6 |

| Cars | 4 – 10 |

| Other vehicles | 4 – 10 |

| Office equipment | 5 – 8 |

| Devices and tools | 5 – 10 |

| IT equipment | 5 – 20 |

| Communication equipment | 5 – 20 |

Impairment

On each balance sheet date, an assessment is made as to whether there are any signs of impairment of the book values of the Jungfraubahn Group's assets. If there are any signs, the recoverable value of the assets is determined. An impairment loss is recognised in profit or loss.

Financial assets

Financial assets are stated at acquisition costs, less value adjustments necessary for economic reasons.

Intangible assets

Intangible assets (software, concessions and rights as well as goodwill) are recognised at cost and depreciated over the estimated or contractually determined useful lives. The planned useful lives for:

| Investment item | Years |

|---|---|

| Software | 5 – 10 |

| Concessions and rights | 15 – 100 |

| Goodwill | 5 |

Liabilities

Liabilities are stated at their nominal value.

Provisions

Provisions are probable obligations that are based on events in the past, the amount and / or maturity of which is uncertain but can be estimated. The valuation is based on uniform business management criteria.

Sales realisation

The revenues of the Jungfraubahn Group stem mainly from the sale of travel tickets (transport income), other important sources of income are the compensation received from government and energy sales. Transport income is realised with the completion of the sales transaction in the sales system and posted in the corresponding period. Proceeds from long-term travel tickets are deferred on a monthly basis and are settled over the entire duration of the travel tickets.

Taxes

Current taxes on profits are deferred on the basis of the business results reported in the reporting year according to the principle of current-year measurement.

For deferred taxes, all differences between tax rates and group values are measured at full tax rates and reported in the balance sheet (comprehensive liability method). The currently applicable tax rate for each company is used for the calculation of the deferred tax burden. Deferred tax assets on tax-deductible losses carried forward are not capitalised but shown in the Notes.

Employee pension funds

The employees of the Jungfraubahn Group extept the Jungfrau Gastronomie AG and the Grindelwald Grund Infrastruktur AG are insured by the legally independent personnel pension fund of Jungfrau Railways. The employees of the Jungfrau Gastronomie AG are insured by the GastroSocial pension fund, the employees of the Grindelwald Grund Infrasturktur AG by the Nest pension fund. The purpose of all three funds is to insure the employees against the economic consequences of age, death and disability. All workers aged over 17 are insured.

The assets of the foundations are not included in the consolidated financial statements. In the statement of income, the contributions demarcated for the period are presented as personnel expenses. The balance sheet includes the corresponding deferred tax assets or liabilities as well as liabilities arising from contractual, regulatory or legal principles. It is assessed annually whether there is an economic benefit or an economic obligation from the organisation's perspective. The annual accounts of the pension funds, which are prepared in Switzerland in accordance with Swiss GAAP FER 26, and other calculations which represent the financial situation, the existing excess cover or shortfall under the actual circumstances, serve as a basis.

Transactions with related parties

In the reporting year, the following material transaction was carried out with a related party: purchase of a business property in Interlaken from BEKB | BCBE as of 1 July 2019 for CHF 11.0 million.

No other significant transactions with related parties took place in the 2019 financial year. In accordance with Swiss GAAP FER 15.8, the legal entities BEKB | BCBE, Gebäudeversicherung Bern and Garaventa AG, which are shown as related parties in the Financial Report 2018, no longer fall under this definition from 1 January 2020.

Segment information

| CHF (thousands) | 2019 | 2018 | Change | in % |

|---|---|---|---|---|

| Segment sales | ||||

| Net sales Jungfraujoch - Top of Europe | 149,839 | 139,216 | 10,623 | 7.6% |

| Net sales Adventure mountains | 32,620 | 27,428 | 5,192 | 18.9% |

| Net sales Winter sports | 30,779 | 28,051 | 2,728 | 9.7% |

| Net sales other segments [1] | 49,125 | 50,130 | -1,005 | -2.0% |

| Elimination group-internal sales | -39,053 | -32,010 | -7,043 | 22.0% |

| Total operating income according to profit and loss account | 223,310 | 212,815 | 10,495 | 4.9% |

| Segment results EBITDA | ||||

| EBITDA Jungfraujoch – Top of Europe | 70,546 | 67,544 | 3,002 | 4.4% |

| EBITDA Adventure mountains | 18,840 | 14,458 | 4,382 | 30.3% |

| EBITDA Winter sports | 1,700 | 339 | 1,361 | 401.5% |

| EBITDA other segments [1] | 11,904 | 12,769 | -865 | -6.8% |

| Group eliminations | -32 | 1 | -33 | -3,300.0% |

| Total EBITDA according to the income statement | 102,958 | 95,111 | 7,847 | 8.3% |

Comments

0 Scope of consolidation

There were no changes in the scope of consolidation in the reporting year.

The following companies are included in the scope of consolidation as of 31 December 2019:

| Company | participation | Consolidation method |

|---|---|---|

| Jungfraubahn Holding AG, Interlaken | parent company | full consolidation |

| Jungfraubahn AG, Interlaken | 100.0% | full consolidation |

| Wengernalpbahn AG, Interlaken | 100.0% | full consolidation |

| Firstbahn AG, Grindelwald | 100.0% | full consolidation |

| Parkhaus Lauterbrunnen AG, Lauterbrunnen | 100.0% | full consolidation |

| Jungfrau Shopping AG, Interlaken [1] | 100.0% | full consolidation |

| Jungfrau Gastronomie AG, Interlaken | 100.0% | full consolidation |

| Bergbahn Lauterbrunnen-Mürren AG, Interlaken | 94.8% | full consolidation |

| Harderbahn AG, Interlaken | 88.6% | full consolidation |

| Grindelwald Grund Infrastruktur AG, Grindelwald | 80.0% | full consolidation |

| Jungfraubahnen Management AG, Interlaken | 67.0% | full consolidation |

| Sphinx AG Jungfraujoch, Fieschertal VS | 57.1% | full consolidation |

| Gondelbahn Grindelwald-Männlichen AG, Grindelwald | 35.5% | equity method |

| Skilift Bumps AG, Wengen | 22.7% | equity method |

1 Receivables from deliveries and services

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Receivables from third parties | 14,815 | 14,750 |

| Receivables from associated companies | 77 | 589 |

| Value adjustments | -939 | -702 |

| Net value | 13,953 | 14,637 |

| Change | -684 |

2 Other current receivables

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Short-term financial assets 4-12 months | 10,000 | 20,020 |

| Various current receivables | 2,331 | 1,653 |

| Total | 12,331 | 21,673 |

| Change | -9,342 |

3 Accrued income

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Operating material and consumables, printed matter, service clothing | 2,460 | 2,403 |

| Credit refund of tax payments | 197 | 389 |

| Credit from energy supplies | 1,273 | 1,005 |

| Prepaid insurance premiums | 2,335 | 1,159 |

| Miscellaneous | 3,084 | 1,659 |

| Total | 9,349 | 6,615 |

| Change | 2,734 |

| CHF (thousands) | Associated companies | Non-consolidated holdings | Loans | Securities | Fixed deposits | Total acquisition values |

|---|---|---|---|---|---|---|

| Acquisition values | ||||||

| Inventory 01/01/2018 | 6,421 | 576 | 419 | 1,298 | 0 | 8,714 |

| Additions | 0 | |||||

| Disposals | -3 | -409 | -35 | -447 | ||

| Inventory 31/12/2018 | 6,418 | 576 | 10 | 1,263 | 0 | 8,267 |

| Additions | 824 | 16 | 840 | |||

| Disposals | -7 | -23 | -30 | |||

| Total acquisition values 31/12/2019 | 6,411 | 576 | 834 | 1,256 | 0 | 9,077 |

| Depreciation and amortisations | ||||||

| Inventory 01/01/2018 | 940 | 50 | 0 | 1,015 | 0 | 2,005 |

| Additions | 0 | |||||

| Disposals | -35 | -35 | ||||

| Inventory 31/12/2018 | 940 | 50 | 0 | 980 | 0 | 1,970 |

| Additions | 0 | |||||

| Disposals | -23 | -23 | ||||

| Total depreciation and amortisations 31/12/2019 | 940 | 50 | 0 | 957 | 0 | 1,947 |

| Balance sheet values | ||||||

| Inventory 31/12/2018 | 5,478 | 526 | 10 | 283 | 0 | 6,297 |

| Inventory 31/12/2019 | 5,471 | 526 | 834 | 299 | 0 | 7,130 |

| Investment item | CHF (thousands) | Balance sheet value 01/01/2019 | Inventory 01/01/2019 | Additions | Reclassification | Disposals | Inventory 31/12/2019 |

|---|---|---|---|---|---|---|---|

| Undeveloped land | 1,484 | 1,945 | 0 | 0 | 0 | 1,945 | |

| Developed land | 11,624 | 12,768 | 1,270 | 763 | 14,801 | ||

| Railway stations | 27,741 | 56,620 | 383 | 50 | 57,053 | ||

| Depots and workshops | 16,760 | 27,595 | 261 | 27,856 | |||

| Railway substructure and superstructure | 81,751 | 114,087 | 1,265 | 506 | -281 | 115,577 | |

| Gondola lift, chair lift and ski lift stations | 15,555 | 36,985 | 11,710 | 48,695 | |||

| Ski slopes and fixed snowmaking equipment | 15,473 | 33,991 | 403 | 20 | 34,414 | ||

| Hiking trails / climbing routes | 313 | 1,127 | 1,127 | ||||

| Power station | 12,872 | 19,174 | 19,174 | ||||

| Restaurants and accommodation | 16,514 | 32,808 | 85 | 380 | 33,273 | ||

| Car parks and parking spaces | 1,719 | 15,970 | 15,970 | ||||

| Residential buildings | 3,024 | 4,941 | 7 | 980 | 5,928 | ||

| Administration buildings | 1,675 | 2,758 | 9,958 | -2,000 | 10,716 | ||

| Other buildings | 49,549 | 102,270 | 1,586 | 2,634 | -7 | 106,483 | |

| Total land and buildings | 254,570 | 461,094 | 26,928 | 5,333 | -2,288 | 491,067 | |

| Railway installations | 37,469 | 89,905 | 2,293 | 3,003 | -2,549 | 92,652 | |

| Gondola lifts | 10,108 | 27,879 | 313 | 51 | 28,243 | ||

| Chairlifts and ski lifts | 20,446 | 52,182 | 295 | -1,104 | 51,373 | ||

| Snowmaking equipment | 1,172 | 4,779 | 59 | 60 | -62 | 4,836 | |

| Power stations | 26,646 | 42,118 | 1,303 | 922 | -2,697 | 41,646 | |

| Other facilities | 9,828 | 21,598 | 9,855 | 452 | -425 | 31,480 | |

| Total facilities | 105,669 | 238,461 | 14,118 | 4,488 | -6,837 | 250,230 | |

| Rail vehicles | 127,030 | 239,816 | 204 | -1,118 | 238,902 | ||

| Slope vehicles | 2,807 | 8,305 | 945 | -415 | 8,835 | ||

| Cars | 605 | 1,261 | 98 | 40 | -31 | 1,368 | |

| Other vehicles | 481 | 1,397 | 93 | -30 | 1,460 | ||

| Total vehicles | 130,923 | 250,779 | 1,340 | 40 | -1,594 | 250,565 | |

| Office equipment | 0 | 1,381 | -233 | 1,148 | |||

| Devices and tools | 2,305 | 9,658 | 122 | 35 | -94 | 9,721 | |

| IT equipment | 870 | 2,863 | 180 | -48 | 2,995 | ||

| Communication equipment | 149 | 336 | 336 | ||||

| Total other property, plant and equipment | 3,324 | 14,238 | 302 | 35 | -375 | 14,200 | |

| Installations under construction | 65,737 | 65,737 | 78,731 | -9,896 | 0 | 134,572 | |

| Spare parts / material supplies | 5,390 | 13,212 | 1,050 | 0 | -725 | 13,537 | |

| Total | 567,097 | 1,045,466 | 122,469 | 0 | -11,819 | 1,156,116 |

| Investment item | CHF (thousands) | Inventory 01/01/2019 | Additions | Reclassification | Disposals | Inventory 31/12/2019 | Balance sheet value 31/12/2019 |

|---|---|---|---|---|---|---|---|

| Undeveloped land | 461 | 0 | 0 | 0 | 461 | 1,484 | |

| Developed land | 1,144 | 1,144 | 13,657 | ||||

| Railway stations | 28,879 | 1,068 | 29,947 | 27,106 | |||

| Depots and workshops | 10,835 | 566 | 11,401 | 16,455 | |||

| Railway substructure and superstructure | 32,336 | 2,513 | -281 | 34,568 | 81,009 | ||

| Gondola lift, chair lift and ski lift stations | 21,430 | 1,225 | 22,655 | 26,040 | |||

| Ski slopes and fixed snowmaking equipment | 18,518 | 1,358 | 19,876 | 14,538 | |||

| Hiking trails / climbing routes | 814 | 123 | 937 | 190 | |||

| Power station | 6,302 | 463 | 6,765 | 12,409 | |||

| Restaurants and accommodation | 16,294 | 660 | 16,954 | 16,319 | |||

| Car parks and parking spaces | 14,251 | 507 | 14,758 | 1,212 | |||

| Residential buildings | 1,917 | 183 | 2,100 | 3,828 | |||

| Administration buildings | 1,083 | 2,128 | -2,000 | 1,211 | 9,505 | ||

| Other buildings | 52,721 | 2,245 | -7 | 54,959 | 51,524 | ||

| Total land and buildings | 206,524 | 13,039 | 0 | -2,288 | 217,275 | 273,792 | |

| Railway installations | 52,436 | 4,276 | -2,542 | 54,170 | 38,482 | ||

| Gondola lifts | 17,771 | 1,230 | 19,001 | 9,242 | |||

| Chairlifts and ski lifts | 31,736 | 1,893 | -1,104 | 32,525 | 18,848 | ||

| Snowmaking equipment | 3,607 | 287 | -62 | 3,832 | 1,004 | ||

| Power stations | 15,472 | 1,148 | -2,697 | 13,923 | 27,723 | ||

| Other facilities | 11,770 | 1,433 | -425 | 12,778 | 18,702 | ||

| Total facilities | 132,792 | 10,267 | 0 | -6,830 | 136,229 | 114,001 | |

| Rail vehicles | 112,786 | 7,810 | -1,118 | 119,478 | 119,424 | ||

| Slope vehicles | 5,498 | 897 | -415 | 5,980 | 2,855 | ||

| Cars | 656 | 131 | -31 | 756 | 612 | ||

| Other vehicles | 916 | 78 | -30 | 964 | 496 | ||

| Total vehicles | 119,856 | 8,916 | 0 | -1,594 | 127,178 | 123,387 | |

| Office equipment | 1,381 | -233 | 1,148 | 0 | |||

| Devices and tools | 7,353 | 469 | -89 | 7,733 | 1,988 | ||

| IT equipment | 1,993 | 214 | -48 | 2,159 | 836 | ||

| Communication equipment | 187 | 37 | 224 | 112 | |||

| Total other property, plant and equipment | 10,914 | 720 | 0 | -370 | 11,264 | 2,936 | |

| Installations under construction | 0 | 0 | 0 | 0 | 0 | 134,572 | |

| Spare parts / material supplies | 7,822 | 224 | 0 | 0 | 8,046 | 5,491 | |

| Total | 478,369 | 33,166 | 0 | -11,082 | 500,453 | 655,663 |

| Investment item | CHF (thousands) | Balance sheet value 01/01/2018 | Inventory 01/01/2018 | Additions | Reclassification | Disposals | Inventory 31/12/2018 |

|---|---|---|---|---|---|---|---|

| Undeveloped land | 1,484 | 1,945 | 0 | 0 | 0 | 1,945 | |

| Developed land | 11,624 | 12,768 | 12,768 | ||||

| Railway stations | 29,090 | 57,163 | -543 | 56,620 | |||

| Depots and workshops | 12,558 | 22,977 | 1,460 | 3,261 | -103 | 27,595 | |

| Railway substructure and superstructure | 80,034 | 110,752 | 3,564 | 566 | -795 | 114,087 | |

| Gondola lift, chair lift and ski lift stations | 16,812 | 36,985 | 36,985 | ||||

| Ski slopes and fixed snowmaking equipment | 16,077 | 33,297 | 726 | 19 | -51 | 33,991 | |

| Hiking trails / climbing routes | 440 | 1,127 | 1,127 | ||||

| Power station | 13,336 | 19,174 | 19,174 | ||||

| Restaurants and accommodation | 17,166 | 32,808 | 32,808 | ||||

| Car parks and parking spaces | 2,139 | 15,935 | 77 | -42 | 15,970 | ||

| Residential buildings | 3,188 | 5,252 | -311 | 4,941 | |||

| Administration buildings | 1,104 | 2,497 | 885 | -624 | 2,758 | ||

| Other buildings | 51,740 | 102,267 | 3 | 102,270 | |||

| Total land and buildings | 255,308 | 453,002 | 6,715 | 3,846 | -2,469 | 461,094 | |

| Railway installations | 36,410 | 88,469 | 3,333 | 1,585 | -3,482 | 89,905 | |

| Gondola lifts | 11,251 | 27,870 | 99 | -90 | 27,879 | ||

| Chairlifts and ski lifts | 21,182 | 53,847 | 1,329 | -2,994 | 52,182 | ||

| Snowmaking equipment | 1,378 | 4,676 | 108 | -5 | 4,779 | ||

| Power stations | 23,847 | 38,313 | 2,599 | 1,207 | -1 | 42,118 | |

| Other facilities | 9,369 | 19,542 | 1,719 | 462 | -125 | 21,598 | |

| Total facilities | 103,437 | 232,717 | 9,187 | 3,254 | -6,697 | 238,461 | |

| Rail vehicles | 128,840 | 235,640 | 2,190 | 4,729 | -2,743 | 239,816 | |

| Slope vehicles | 2,193 | 8,616 | 1,447 | -1,758 | 8,305 | ||

| Cars | 571 | 1,239 | 130 | 22 | -130 | 1,261 | |

| Other vehicles | 361 | 1,294 | 201 | -98 | 1,397 | ||

| Total vehicles | 131,965 | 246,789 | 3,968 | 4,751 | -4,729 | 250,779 | |

| Office equipment | 0 | 1,393 | -12 | 1,381 | |||

| Devices and tools | 2,635 | 9,669 | 121 | -132 | 9,658 | ||

| IT equipment | 1,009 | 2,910 | 96 | -143 | 2,863 | ||

| Communication equipment | 187 | 336 | 336 | ||||

| Total other property, plant and equipment | 3,831 | 14,308 | 217 | 0 | -287 | 14,238 | |

| Installations under construction | 22,923 | 22,923 | 54,665 | -11,851 | 0 | 65,737 | |

| Spare parts / material supplies | 5,978 | 13,574 | 383 | 0 | -745 | 13,212 | |

| Total | 524,926 | 985,258 | 75,135 | 0 | -14,927 | 1,045,466 |

| Investment item | CHF (thousands) | Inventory 01/01/2018 | Additions | Reclassification | Disposals | Inventory 31/12/2018 | Balance sheet value 31/12/2018 |

|---|---|---|---|---|---|---|---|

| Undeveloped land | 461 | 0 | 0 | 0 | 461 | 1,484 | |

| Developed land | 1,144 | 1,144 | 11,624 | ||||

| Railway stations | 28,073 | 1,349 | -543 | 28,879 | 27,741 | ||

| Depots and workshops | 10,419 | 519 | -103 | 10,835 | 16,760 | ||

| Railway substructure and superstructure | 30,718 | 2,413 | -795 | 32,336 | 81,751 | ||

| Gondola lift, chair lift and ski lift stations | 20,173 | 1,257 | 21,430 | 15,555 | |||

| Ski slopes and fixed snowmaking equipment | 17,220 | 1,349 | -51 | 18,518 | 15,473 | ||

| Hiking trails / climbing routes | 687 | 127 | 814 | 313 | |||

| Power station | 5,838 | 464 | 6,302 | 12,872 | |||

| Restaurants and accommodation | 15,642 | 652 | 16,294 | 16,514 | |||

| Car parks and parking spaces | 13,796 | 497 | -42 | 14,251 | 1,719 | ||

| Residential buildings | 2,064 | 164 | -311 | 1,917 | 3,024 | ||

| Administration buildings | 1,393 | 314 | -624 | 1,083 | 1,675 | ||

| Other buildings | 50,527 | 2,194 | 52,721 | 49,549 | |||

| Total land and buildings | 197,694 | 11,299 | 0 | -2,469 | 206,524 | 254,570 | |

| Railway installations | 52,059 | 3,859 | -3,482 | 52,436 | 37,469 | ||

| Gondola lifts | 16,619 | 1,242 | -90 | 17,771 | 10,108 | ||

| Chairlifts and ski lifts | 32,665 | 2,065 | -2,994 | 31,736 | 20,446 | ||

| Snowmaking equipment | 3,298 | 314 | -5 | 3,607 | 1,172 | ||

| Power stations | 14,466 | 1,007 | -1 | 15,472 | 26,646 | ||

| Other facilities | 10,173 | 1,722 | -125 | 11,770 | 9,828 | ||

| Total facilities | 129,280 | 10,209 | 0 | -6,697 | 132,792 | 105,669 | |

| Rail vehicles | 106,800 | 8,729 | -2,743 | 112,786 | 127,030 | ||

| Slope vehicles | 6,423 | 833 | -1,758 | 5,498 | 2,807 | ||

| Cars | 668 | 118 | -130 | 656 | 605 | ||

| Other vehicles | 933 | 81 | -98 | 916 | 481 | ||

| Total vehicles | 114,824 | 9,761 | 0 | -4,729 | 119,856 | 130,923 | |

| Office equipment | 1,393 | -12 | 1,381 | 0 | |||

| Devices and tools | 7,034 | 451 | -132 | 7,353 | 2,305 | ||

| IT equipment | 1,901 | 235 | -143 | 1,993 | 870 | ||

| Communication equipment | 149 | 38 | 187 | 149 | |||

| Total other property, plant and equipment | 10,477 | 724 | 0 | -287 | 10,914 | 3,324 | |

| Installations under construction | 0 | 0 | 0 | 0 | 0 | 65,737 | |

| Spare parts / material supplies | 7,596 | 332 | 0 | -106 | 7,822 | 5,390 | |

| Total | 460,332 | 32,325 | 0 | -14,288 | 478,369 | 567,097 |

| CHF (thousands) | Concessions and rights | Software | Goodwill | Total acquisition values |

|---|---|---|---|---|

| Acquisition values | ||||

| Inventory 01/01/2018 | 4,700 | 10,570 | 428 | 15,698 |

| Additions | 1,903 | 1,903 | ||

| Reclassification | 0 | |||

| Disposals | -205 | -77 | -282 | |

| Inventory 31/12/2018 | 4,495 | 12,396 | 428 | 17,319 |

| Additions | 920 | 2,058 | 762 | 3,740 |

| Reclassification | 0 | |||

| Disposals | -181 | -644 | -825 | |

| Total Acquisition values 31/12/2019 | 5,234 | 13,810 | 1,190 | 20,234 |

| Depreciation and impairments | ||||

| Inventory 01/01/2018 | 2,272 | 4,261 | 428 | 6,961 |

| Additions | 126 | 1,691 | 1,817 | |

| Reclassification | 0 | |||

| Disposals | -205 | -77 | -282 | |

| Inventory 31/12/2018 | 2,193 | 5,875 | 428 | 8,496 |

| Additions | 118 | 2,018 | 152 | 2,288 |

| Reclassification | 0 | |||

| Disposals | -181 | -644 | -825 | |

| Depreciation and impairments 31/12/2019 | 2,130 | 7,249 | 580 | 9,959 |

| Balance sheet values | ||||

| Inventory 31/12/2018 | 2,302 | 6,521 | 0 | 8,823 |

| Inventory 31/12/2019 | 3,104 | 6,561 | 610 | 10,275 |

7 Liabilities from deliveries and services

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Liabilities from deliveries and services owed to third parties | 38,201 | 27,858 |

| Liabilities from deliveries and services owed to related parties | 0 | 260 |

| Liabilities from deliveries and services owed to associated companies | 37 | 51 |

| Total | 38,238 | 28,169 |

| Change | 10,069 |

8 Financial liabilities / net financial assets

| CHF (thousands) | 2019 | Maturity less than 1 year | Maturity more than 1 year | Conditionally repayable | Unused limits | 2018 |

|---|---|---|---|---|---|---|

| Confederation and canton loan under Art. 56 Railway Conveyance Act (non-interest-bearing) | 43,279 | 740 | 42,539 | 42,011 | ||

| Confederation and canton loan under NRP (non-interest-bearing) | 7,800 | 7,800 | 0 | |||

| Bank liabilities | 0 | 124,400 | 0 | |||

| Total financial liabilities | 51,079 | 740 | 7,800 | 42,539 | 124,400 | 42,011 |

| Liquid funds | 57,432 | 87,390 | ||||

| Net financial assets | 6,353 | 45,379 | ||||

| Change on previous year | -39,026 |

9 Other current liabilities

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Direct tax | 3,658 | 3,817 |

| Social security liabilities | 38 | 346 |

| Clearing balance Jungfrau Ski Region and SBB | 186 | 3,009 |

| Various other liabilities | 725 | 240 |

| Liabilities to shareholders [1] | 198 | 177 |

| Total | 4,805 | 7,589 |

| Change | -2,784 |

| CHF (thousands) | Holidays / overtime | Various | Demolition Ostgrat building | Deferred taxes | Total provisions |

|---|---|---|---|---|---|

| Book value at 01/01/2018 | 1,875 | 100 | 950 | 41,144 | 44,069 |

| Formation | 279 | 0 | 411 | 690 | |

| Use | -100 | -100 | |||

| Dissolution | -104 | -1,274 | -1,378 | ||

| Book value at 31/12/2018 | 2,050 | 0 | 950 | 40,281 | 43,281 |

| of which short-term | 2,050 | 0 | 0 | 0 | 2,050 |

| Book value at 01/01/2019 | 2,050 | 0 | 950 | 40,281 | 43,281 |

| Formation | 350 | 308 | 658 | ||

| Dissolution | -134 | -816 | -950 | ||

| Book value at 31/12/2019 | 2,266 | 0 | 950 | 39,773 | 42,989 |

| of which short-term | 2,266 | 0 | 0 | 0 | 2,266 |

11 Deferred income

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Demarcation of transport income from subscriptions | 8,166 | 6,936 |

| Direct tax | 7,319 | 7,238 |

| Profit sharing | 1,029 | 1,008 |

| Other demarcations | 7,467 | 8,424 |

| Total | 23,981 | 23,606 |

| Change | 375 |

12 Transportation revenues

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Jungfraujoch – Top of Europe | 120,895 | 118,798 |

| Adventure mountains | 25,017 | 20,661 |

| Winter sports | 23,464 | 22,324 |

| Gross transportation revenues | 169,376 | 161,783 |

| Reductions in revenue | -7,569 | -7,950 |

| Total | 161,807 | 153,833 |

| Change | 7,974 |

13 Compensation received from government

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Lauterbrunnen–Wengen infrastructure | 4,769 | 4,821 |

| Regional passenger transport Lauterbrunnen–Wengen | 1,493 | 1,393 |

| Freight transport Lauterbrunnen–Wengen | 1,900 | 1,900 |

| Regional passenger transport Lauterbrunnen–Mürren | 2,389 | 2,140 |

| Total | 10,551 | 10,254 |

| Change | 297 |

The uncovered costs of the transport service ordered by the public authorities (Federation and Canton of Bern) on the routes Lauterbrunnen–Mürren and Lauterbrunnen–Wengen are paid by the purchaser. The corresponding compensation must be negotiated in advance.

14 Rental income

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Catering rental rates | 1,818 | 1,766 |

| Renting of parking spaces | 2,692 | 2,535 |

| Renting of residential and commercial spaces | 1,497 | 1,254 |

| Other renting | 2,543 | 2,613 |

| Total | 8,550 | 8,168 |

| Change | 382 |

15 Other income

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Adventure offers | 4,043 | 3,398 |

| Events | 812 | 1,313 |

| Various income | 2,647 | 2,518 |

| Capitalised costs | 1,591 | 1,461 |

| Income from sales of assets | 70 | 253 |

| Total | 9,163 | 8,943 |

| Change | 220 |

16 Cost of goods

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Souvenir shops | -4,032 | -4,055 |

| Catering and accommodation | -1,551 | -1,398 |

| Total | -5,583 | -5,453 |

| Change | -130 |

17 Personnel expenses

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Salaries and wages | -45,439 | -43,527 |

| Allowances, uniforms and other benefits | -6,624 | -6,634 |

| Social expenditure | -9,138 | -9,028 |

| remaining personnel expenses | -1,477 | -1,480 |

| Insurance payments | 588 | 496 |

| Total | -62,090 | -60,173 |

| Change | -1,917 | |

| Employees (full-time positions) | 612 | 600 |

| Change | 12 |

The compensation paid to the Management booked under personnel expenses is shown in the remuneration report of Jungfraubahn Holding AG.

18 Employee benefit plans

| Number of people | 2019 | 2018 |

|---|---|---|

| Active insured persons | 717 | 634 |

| Pensioners | 262 | 254 |

| Total persons | 979 | 888 |

| Change | 91 | |

| Expenditure for employee benefit plans in thousands of CHF (included in social expenses) | -4,420 | -4,302 |

| Change | -118 |

19 Pension plans

| Economic benefit / economic commitment [1] | Tausend CHF | Surplus cover / shortfall at 31/12/2018 | Surplus cover / shortfall at 31/12/2017 | Economic part of the organisation at 31/12/2018 | Economic part of the organisation at 31/12/2017 |

|---|---|---|---|---|---|

| Pension plan with surplus cover | |||||

| Jungfrau Railways pension fund [2] | 0 | 0 | 0 | 0 | |

| GastroSocial pension fund [3] | 0 | 0 | 0 | 0 | |

| Nest pension fund [4] | – | – | – | – | |

| Total | 0 | 0 | 0 | 0 | |

| Change | 0 | 0 |

| Pension expenses in personnel expenses | CHF (thousands) | 2019 | 2018 |

|---|---|---|---|

| Jungfrau Railways pension fund | -4,057 | -3,986 | |

| GastroSocial pension fund | -102 | -77 | |

| Nest pension fund | -13 | 0 | |

| Total | -4,172 | -4,063 | |

| Change | -109 |

Management insurance is maintained for members of management and extended management. Expenses for the companies amounted to kCHF 248 in 2019 and kCHF 239 in 2018.

20 Other operating expenses

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Costs for services | -13,347 | -8,929 |

| Rent expenses | -472 | -519 |

| Maintenance, renovation and demolition | -10,710 | -10,434 |

| Insurance and compensation | -1,477 | -1,249 |

| Energy and consumables | -2,672 | -2,280 |

| General expenses | -9,768 | -14,588 |

| IT | -5,128 | -4,712 |

| Marketing | -5,747 | -5,905 |

| Events | -1,053 | -1,350 |

| Total | -50,374 | -49,966 |

| Change | -408 |

General expenses mainly include administrative costs, fees and duties as well as various sponsorship and cost contributions. The compensation paid to Board members as a general expense is disclosed in the remuneration report of Jungfraubahn Holding AG.

21 Financial expenses

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Interest paid | -42 | -101 |

| Relative exchange rate losses | -13 | -30 |

| Other financial expenses | -199 | -233 |

| Total | -254 | -364 |

| Change | 110 |

22 Financial income

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Interest received | 84 | 95 |

| Relative exchange rate gains | 73 | 86 |

| Badwill from the purchase of shares in subsidiaries | 112 | 6 |

| Various income | 183 | 173 |

| Total | 452 | 360 |

| Change | 92 |

23 Taxes on profits

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Distribution by tax type | ||

| Current income taxes | -14,859 | -13,999 |

| Deferred income taxes | 508 | 863 |

| Total | -14,351 | -13,136 |

| Change | -1,215 | |

| Analysis of taxes on profits | ||

| Ordinary earnings before taxes on profits | 67,695 | 60,962 |

| Average applicable tax rate before taking account of losses carried forward | 22.2% | 22.3% |

| Expected taxes on profits related to the ordinary result | -15,001 | -13,601 |

| Effect of changes in non-capitalised losses carried forward | -282 | -402 |

| Effect of tax-free results | 813 | 560 |

| Other effects | 119 | 307 |

| Total | -14,351 | -13,136 |

| Effective tax rate | 21.2% | 21.5% |

The Group's average income tax rate is based on the weighted average tax rate resulting from the profit or loss before tax as well as the tax rate of each individual company.

With the companies Bergbahn Lauterbrunnen-Mürren AG, Grindelwald Grund Infrastruktur AG, Jungfrau Gastronomie AG as well as Jungfrau Shopping AG there are tax-deductible losses carried forward totalling kCHF 5,669 (previous year kCHF 4,492). The resulting non-capitalised deferred tax claim is kCHF 1,267 (previous year kCHF 985).

24 Equity

Share capital

The share capital of Jungfraubahn Holding AG is fully paid up, amounting to CHF 8,752,500 at 31 December 2019 and is divided into 5,835,000 registered shares with a nominal value of CHF 1.50. Rights and restrictions related to the shares are explained in Section 6 of the Corporate Governance report.

Treasury shares

At 31 December 2019, the company held 1,085 registered treasury shares with a nominal value of CHF 1.50 each (previous year 3,018 registered treasury shares). In the reporting year, 20,052 (previous year: 20,000) of the Company's registered treasury shares were purchased at an average price of CHF 131.54 (previous year: CHF 145.88) and 21,985 (previous year 20,575) registered treasury shares were sold at an average price of CHF 154.12 (previous year CHF 139.91).

Since 2005, the employees of the Jungfrau Railway Group as well as the administrative boards of Jungfraubahn Holding AG have been given the option of voluntarily purchasing a limited number of registered shares of Jungfraubahn Holding AG at a preferential price. In the reporting year, this price was CHF 45.00 per registered share (previous year CHF 43.00). The difference between the preferential price and the exchange rate, determined according to circular no. 37 of the Federal Tax Administration, was recognised in the income statement under personnel expenses. In this way 21,685 registered treasury shares were sold in the reporting year (previous year 20,294).

The share ownership of the Board members and management is shown in the annexe to the financial statements of Jungfraubahn Holding AG.

Reserves

The non-distributable, statutory or legal reserves amounted to kCHF 28,636 at 31 December 2019 (previous year kCHF 26,279).

25 Other information

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Investment obligations | 53,095 | 34,024 |

| Sureties, guarantees and pledges in favour of third parties | ||

| Assets pledged to secure building lease charges | 51 | 51 |

| Guarantee obligations | 64 | 90 |

| Joint guarantee Verein Int. Lauberhornrennen Wengen | 500 | 500 |

| Joint and several liability for all value-added tax liabilities of the Jungfraubahn Group and Berner Oberland-Bahnen AG | p.m. | p.m. |

| Joint and several liability for the obligations of the simple partnership Jungfrau Ski Region | p.m. | p.m. |

| Other obligations not to be recognised | ||

| Lease obligations from long-term leases | 12,875 | 12,258 |

| • of which due within 1 year | 567 | 500 |

| • of which due in 1-5 years | 1,753 | 1,451 |

| • of which due in more than 5 years | 10,555 | 10,307 |

26 Events after the balance sheet date

On 11 March 2020, the World Health Organisation (WHO) classified the global spread of the Coronavirus (COVID-19) as a pandemic. As a result, the ski area and the cogwheel railways above Grindelwald and Wengen were officially closed on 14 March 2020. They remain closed at the time of publication of this Financial Report. The Board of Directors and Executive Board of Jungfraubahn Holding AG are monitoring events and will take the necessary measures on an ongoing basis. At the time of approval of these consolidated financial statements, the financial consequences of the direct and indirect effects of this pandemic on the current financial year 2020 cannot yet be estimated. On the other hand, the significance of the 2019 consolidated financial statements will not be affected by the consequences of the coronavirus pandemic.

Auditor's report on the consolidated financial statements

The object of the official annual report of Jungfraubahn Holding AG is the management report (with segment reporting) and the financial report, which contains the consolidated financial statements for 2019 and the financial statements for 2019 of the holding company. The auditor's reports are also included in this part of the annual report. The printout of the annual report in German, available at the registered offices of the company during the invitation period to the General Meeting of Jungfraubahn Holding AG, is binding and has been audited. Thus no audit reports were drawn up in English. You can download a PDF document with the same content from the online annual report Download Centre. The accompanying report and the download file also contain the 2019 remuneration report and corporate governance information.

Development

Key figures 2015 to 2019

| CHF (thousands) | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|

| Balance sheet | |||||

| Current assets | 95,769 | 132,099 | 116,387 | 79,613 | 70,081 |

| Fixed assets | 673,068 | 582,217 | 540,372 | 545,691 | 528,048 |

| Outside capital | 161,528 | 144,656 | 120,848 | 119,187 | 110,658 |

| Equity | 607,309 | 569,660 | 535,911 | 506,117 | 487,471 |

| Balance sheet total | 768,837 | 714,316 | 656,759 | 625,304 | 598,129 |

| Income statement | |||||

| Operating income | 223,310 | 212,815 | 193,770 | 169,030 | 175,488 |

| Transportation revenues | 161,807 | 153,833 | 143,799 | 125,984 | 133,969 |

| Operating expenses | 120,352 | 117,704 | 106,027 | 97,951 | 96,093 |

| Personnel expenses | 62,090 | 60,173 | 55,276 | 53,402 | 53,440 |

| EBITDA | 102,958 | 95,111 | 87,743 | 71,079 | 79,395 |

| Depreciation and amortisation | 35,454 | 34,142 | 34,705 | 34,747 | 32,395 |

| EBIT (operating profit) | 67,504 | 60,969 | 53,038 | 36,332 | 47,000 |

| Annual profit | 53,344 | 47,826 | 41,601 | 30,964 | 36,485 |

| Cash flow statement | |||||

| Cash flow from operating activities | 97,086 | 79,885 | 63,593 | 68,519 | 63,256 |

| Cash flow from investing activities | -118,597 | -63,580 | -29,756 | -50,408 | -57,813 |

| Cash flow from financing activities | -8,447 | -11,199 | -10,394 | -8,358 | -6,052 |

| Free cash flow | -21,511 | 16,305 | 33,837 | 18,111 | 5,443 |

| Key figures | |||||

| Equity ratio | 79.0% | 79.7% | 81.6% | 80.9% | 81.5% |

| EBITDA in relation to operating income | 46.1% | 44.7% | 45.3% | 42.1% | 45.2% |

| EBIT in relation to operating income | 30.2% | 28.6% | 27.4% | 21.5% | 26.8% |

| Return on sales (ROS) | 23.9% | 22.5% | 21.5% | 18.3% | 20.8% |

| Number of personnel | 612 | 600 | 542 | 536 | 525 |

| Earnings per employee | 365 | 355 | 358 | 315 | 334 |

| Personnel expenses in relation to operating income | 27.8% | 28.3% | 28.5% | 31.6% | 30.5% |

Charts 2015 to 2019

Operating income / transportation revenue

Results

Free Cashflow

Earnings per share

Information for shareholders

Information per registered share

| Information per share [1] in CHF | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|

| Nominal value | 1.50 | 1.50 | 1.50 | 1.50 | 1.50 |

| Voting rights | 1 | 1 | 1 | 1 | 1 |

| Net profit [2] | 9.08 | 8.21 | 7.08 | 5.30 | 6.21 |

| Dividends (2019: proposal) [3] | 2.80 | 2.80 | 2.40 | 2.10 | 2.00 |

| Equity [2] | 103.31 | 96.90 | 91.09 | 86.03 | 82.58 |

| Stock market price | |||||

| High | 167.00 | 167.50 | 134.70 | 110.50 | 100.80 |

| Low | 130.50 | 123.50 | 95.10 | 88.80 | 70.70 |

| Year-end price | 165.00 | 125.50 | 127.20 | 97.50 | 94.85 |

| Key data [1] | |||||

| Price/earnings ratio | 18.17 | 15.28 | 17.97 | 18.41 | 15.27 |

| Price/equity | 159.7% | 129.5% | 139.6% | 113.3% | 114.9% |

| Payout ratio | 30.8% | 34.1% | 33.9% | 39.7% | 32.2% |

| Dividend yield [3] | 1.7% | 2.2% | 1.9% | 2.2% | 2.1% |

| Stock return [3] | 33.2% | 0.9% | 32.3% | 4.9% | 27.7% |

Share price (closing price) Jungfraubahn Holding AG, January to December 2019

Group structure

As at 31/12/2019

Jungfraubahn Holding AG

Balance sheet

| CHF (thousands) | 2019 | % | 2018 | % |

|---|---|---|---|---|

| Assets | ||||

| Current assets | ||||

| Liquid funds | 25,966 | 51,499 | ||

| Other receivables from third parties | 10,381 | 20,375 | ||

| Other receivables from participating interests | 2,123 | 105 | ||

| Accrued income | 23 | 20 | ||

| Total current assets | 38,493 | 17.6% | 71,999 | 36.4% |

| Fixed assets | ||||

| Loans to group companies | 155,580 | 101,720 | ||

| Participating interests | 24,884 | 24,335 | ||

| Total fixed assets | 180,464 | 82.4% | 126,055 | 63.6% |

| Total Assets | 218,957 | 100.0% | 198,054 | 100.0% |

| Liabilities | ||||

| Outside capital | ||||

| Current interest-bearing liabilities owed to third parties | 186 | 3,009 | ||

| Current interest-bearing liabilities for participating interests | 59,830 | 37,194 | ||

| Other current liabilities owed to third parties | 0 | 4 | ||

| Other current liabilities owed to shareholders | 193 | 177 | ||

| Deferred income | 396 | 367 | ||

| Current provisions | 0 | 0 | ||

| Total current borrowed capital | 60,605 | 40,751 | ||

| Total non-current borrowed capital | 0 | 0 | ||

| Total borrowed capital | 60,605 | 27.7% | 40,751 | 20.6% |

| Equity | ||||

| Share capital | 8,753 | 8,753 | ||

| Statutory retained earnings | 25,612 | 25,612 | ||

| • Profit carried forward | 74,184 | 73,802 | ||

| • Statutory and final reserves | 32,920 | 32,920 | ||

| Voluntary retained earnings | 107,104 | 106,722 | ||

| Own capital shares | -144 | -440 | ||

| Annual result | 17,027 | 16,656 | ||

| Total equity | 158,352 | 72.3% | 157,303 | 79.4% |

| Total liabilities | 218,957 | 100.0% | 198,054 | 100.0% |

Income statement

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Operating income | ||

| Service income | 866 | 835 |

| Total operating income | 866 | 835 |

| Operating expenses | ||

| Administration expenses | -1,542 | -1,728 |

| Total operating expenses | -1,542 | -1,728 |

| Financial result | ||

| Depreciation on investments | -762 | 0 |

| Other financial expenses | -340 | -267 |

| Investment income | 16,972 | 16,640 |

| Other financial income | 1,889 | 1,211 |

| Total financial result | 17,759 | 17,584 |

| Direct tax | -56 | -35 |

| Annual profit | 17,027 | 16,656 |

Profit sharing

Application concerning the use of balance sheet profits

| CHF | CHF | |

|---|---|---|

| Annual profit 2019 | 17,027,238 | |

| Profit balance carried forward according to AGM resolution of 13 May 2019 | 74,119,548 | |

| Undistributed dividends from own shares | 64,372 | |

| Profit balance carried forward according to annual financial statement | 74,183,920 | 74,183,920 |

| Balance sheet profit available to the AGM | 91,211,158 | |

| Executive Board proposal: | ||

| Distribution of a dividend of CHF 2.80 per share on 5,835,000 registered shares. CHF 1.50 | -16,338,000 | |

| Amount to be carried forward | 74,873,158 |

Notes to the financial statements

Basis

The 2019 annual accounts of Jungfraubahn Holding AG, Interlaken, have been prepared in accordance with the provisions of Swiss Accounting Law (Section 32 of the Swiss Code of Obligations).

Various information

Jungfraubahn Holding AG did not employ any staff in the reporting year nor in the previous year.

Events after the balance sheet date

On 11 March 2020, the World Health Organisation (WHO) classified the global spread of the Coronavirus (COVID-19) as a pandemic. As a result, the ski area and the cogwheel railways above Grindelwald and Wengen were officially closed on 14 March 2020. They remain closed at the time of publication of this Financial Report. The Board of Directors and Executive Board of Jungfraubahn Holding AG are monitoring events and will take the necessary measures on an ongoing basis. At the time of approval of these consolidated financial statements, the financial consequences of the direct and indirect effects of this pandemic on the current financial year 2020 cannot yet be estimated. On the other hand, the significance of the 2019 consolidated financial statements will not be affected by the consequences of the coronavirus pandemic.

Treasury shares

| CHF (thousands) | 2019 | 2018 | |

|---|---|---|---|

| Inventory on 1st January | (2019: 3,018 shares, 2018: 3,593 shares) | 440 | 399 |

| Purchases | (2019: 20,000 shares, 2018: 20,000 shares) | 2,638 | 2,917 |

| Sales | (2019: 20,575 shares, 2018: 20,575 shares) | -3,388 | -2,878 |

| Success | 454 | 2 | |

| Inventory on 31st December | (2019: 1,085 shares, 2018: 3,018 shares) | 144 | 440 |

| Average price of purchased treasury shares (CHF) | 131.54 | 145.88 | |

| Average price of treasury shares sold (CHF) | 154.12 | 139.91 |

Holdings / voting rights in per cent

| Share capital CHF (thousands) | 2019 | 2018 | |

|---|---|---|---|

| Group companies | |||

| Jungfraubahn AG, Interlaken; operation of a rack railway from Kleine Scheidegg to Jungfraujoch | 10,000 | 100.0% | 100.0% |

| Wengernalpbahn AG, Interlaken; operation of a rack railway, chair lifts and ski lifts | 10,000 | 100.0% | 100.0% |

| Firstbahn AG, Grindelwald; operation of the First Railway as well as chairlifts and ski lifts, hotels and restaurants | 10,000 | 100.0% | 100.0% |

| Parkhaus Lauterbrunnen AG, Lauterbrunnen; construction and operation of Lauterbrunnen car park | 1,000 | 100.0% | 100.0% |

| Jungfrau Shopping AG, Interlaken; trade in accessories and goods of all kinds [1] | 100 | 100.0% | 100.0% |

| Jungfrau Gastronomie AG, Interlaken; operation of hotels and restaurants | 100 | 100.0% | 100.0% |

| Bergbahn Lauterbrunnen-Mürren AG; operation of cable car and narrow gauge railway from Lauterbrunnen to Mürren | 1,800 | 94.8% | 94.1% |

| Harderbahn AG, Interlaken; Interlaken-Harder cable car and Harder Kulm restaurant | 705 | 88.6% | 88.5% |

| Grindelwald Grund Infrastruktur AG, Grindelwald; creating, maintaining and managing the infrastructure of railway stations, terminal, car park | 10,000 | 80.0% | 80.0% |

| Jungfraubahnen Management AG, Interlaken; management / company consultancy, provision of services | 100 | 67.0% | 67.0% |

| Sphinx AG Jungfraujoch, Fieschertal VS; ownership and management of Sphinx buildings, Jungfraujoch | 53 | 57.1% | 57.1% |

| Associated companies | |||

| Gondelbahn Grindelwald-Männlichen AG, Grindelwald; operation of gondola lift and ski lifts in the Männlichen area | 11,000 | 35.5% | 35.5% |

| Skilift Bumps AG, Wengen; creation, operation and maintenance of a ski lift on the Wickibort | 220 | 22.7% | 22.7% |

| Deviating voting rights in holdings as a percentage | |||

| Gondelbahn Grindelwald-Männlichen AG, Grindelwald | 34.8% | 34.8% | |

| Other significant holdings | |||

| Intersport Rent-Network Jungfrau Region AG, Grindelwald | 400 | 12.5% | 12.5% |

| Berner Oberland-Bahnen AG, Interlaken | 12,341 | 8.1% | 8.1% |

Shareholder structure

| 2019 | 2018 | |

|---|---|---|

| Significant shareholders | ||

| BEKB | BCBE (Berner Kantonalbank), Bern | 14.2% | 14.2% |

| Gebäudeversicherung Bern, Bern | 5.5% | 7.4% |

| JSP Sicherheitsdienste, Alarmempfang und Intervention (Schweiz) AG, Zollikofen | 4.7% | 4.7% |

| Erwin Reinhardt, Muri b. Bern [1] | 4.4% | 4.4% |

| Martin Haefner, Horw | 4.0% | 4.0% |

Further information

| CHF (thousands) | 2019 | 2018 |

|---|---|---|

| Sureties, guarantees and pledges in favour of third parties | ||

| Joint guarantee Grindelwald Grund Infrastruktur AG | 7,800 | 0 |

| Joint and several liability for all value-added tax liabilities of the Jungfraubahn Group and the Berner Oberland-Bahnen AG | p.m. | p.m. |

| Net release of silent reserves | 0 | 2 |

| Disclosure under Art. 663c OR | Number of shares 2019 | Number of shares 2018 | Voting rights share 2019 |

|---|---|---|---|

| Board of Directors | |||

| Prof. Thomas Bieger, Board Chairman | 11,460 | 10,750 | 0.20% |

| Ueli Winzenried, Board Vice-Chairman | 5,210 | 4,500 | 0.09% |

| Peter Baumann, Board of Directors | 7,077 | 6,367 | 0.12% |

| Nils Graf, Board of Directors | 6,373 | 5,663 | 0.11% |

| Dr. Catrina Luchsinger Gähwiler, Board of Directors | 1,460 | 750 | 0.03% |

| Hanspeter Rüfenacht, Board of Directors | 2,310 | 1,600 | 0.04% |

| Total Board of Directors | 33,890 | 29,630 | 0.59% |

| Company Management | |||

| Urs Kessler, Chairman of the Executive Board | 36,008 | 34,000 | 0.62% |

| Christoph Schläppi, Head of Corporate Services | 9,795 | 9,495 | 0.17% |

| Christoph Seiler, Head of Finances and Controlling | 15,492 | 17,058 | 0.27% |

| Total management | 61,295 | 60,553 | 1.06% |

The relationships between the largest shareholders and individual members of the Board of Directors are disclosed in Figure 3.1 of the Corporate Governance Report. This connection is classified as «not related». There is no attribution of the shareholding held by the major shareholders to individual Board members.

Auditor's report

The object of the official annual report of Jungfraubahn Holding AG is the management report (with segment reporting) and the financial report, which contains the consolidated financial statements for 2019 and the financial statements for 2019 of the holding company. The auditor's reports are also included in this part of the annual report. The printout of the annual report in German, available at the registered offices of the company during the invitation period to the General Meeting of Jungfraubahn Holding AG, is binding and has been audited. Thus no audit reports were drawn up in English. You can download a PDF document with the same content from the online annual report Download Centre. The accompanying report and the download file also contain the 2019 remuneration report and corporate governance information.

Revised dividend proposal from 20 April 2020

The invitation to cast votes at the 26th Annual General Meeting of Jungfraubahn Holding AG was publicised on 16 April 2020. On 20 April 2020, the Board of Directors revisited its decision with regard to the dividends from March 2020 and is now proposing to forgo a distribution of dividends. The Board of Directors has thus changed its proposal for agenda item 2, use of balance sheet profit and dividend resolution. All other proposals by the Board of Directors remain unchanged.

Revised dividend proposal

| CHF | CHF | |

|---|---|---|

| Annual profit 2019 | 17,027,238 | |

| Profit balance carried forward according to AGM resolution of 13 May 2019 | 74,119,548 | |

| Undistributed dividends from own shares | 64,372 | |

| Profit balance carried forward according to annual financial statement | 74,183,920 | 74,183,920 |

| Balance sheet profit available to the AGM | 91,211,158 | |

| Executive Board proposal: | ||

| Forgoing distribution of dividends and carrying over the balance sheet profit to new account | 91,211,158 |

Interlaken, 20 April 2020

For the Board of Directors of Jungfraubahn Holding AG

Prof. Dr. Thomas Bieger, Chairman; Ueli Winzenried, Vice-Chairman

Auditor's report on the revised dividend proposal

The printout of the revised dividend proposal in German, available at the registered offices of the company during the invitation period to the General Meeting of Jungfraubahn Holding AG, is binding and has been audited. Thus no audit reports were drawn up in English. You can download a PDF document with the same content from the online annual report Download Centre.

Subsidiaries

Jungfraubahn AG

It is from Kleine Scheidegg that Jungfrau Railways opens up access to the world-famous excursion destination of Jungfraujoch – Top of Europe. Every year, the Jungfrau Railway transports guests from all over the world to Europe’s highest railway station, set in permanent snow and ice. On the Jungfraujoch and on the Eigergletscher, guests are catered for by a number of gastronomy locations. In the Top of Europe Shops located on the Jungfraujoch, Kleine Scheidegg, on First and in Interlaken, the company sells typical Swiss souvenirs, clothing and accessories. Since its founding, Jungfraubahn AG has been producing electricity in its own hydroelectric power plant in Lütschental, while also providing energy supply services.

Company data

| Route | Route length (all rack) | 9.3 km |

| Length of tunnel | 7.6 km | |

| Altitude difference | 1,393 m | |

| Most important rolling stock | Double carriage | 8 |

| Low-floor control cars | 4 | |

| Conveying capacity per hour | Seats | 1,060 |

| Jungfraujoch catering (leased) | Restaurant (elevated) | 1 |

| Bar | 1 | |

| Self-service | 1 | |

| Group restaurants | 2 | |

| Total seats | 730 | |

| Eigergletscher catering (leased) | Restaurant | 1 |

| Ski bar | 1 | |

| Seats | 320 | |

| Shopping area Top of Europe Shops | Jungfraujoch | 140 m2 |

| Kleine Scheidegg | 40 m2 | |

| First | 60 m2 | |

| Interlaken | 290 m2 |

Key figures

| Operating values, in thousands of CHF | 2019 | 2018 |

|---|---|---|

| Employees (full-time positions) | 151 | 139 |

| • of which learners | 4 | 4 |

| Holdings of Jungfraubahn Holding AG | 100.0% | 100.0% |